ANYA IPO, Anya Polytech and Fertilizers IPO will be open for bidding from 26th Dec 2024 till 2nd Jan 2025. The issue size is 45 crores and the offer price per share is ₹13 to ₹14. But investors have to take care of the lot size because the lot size for ANYA IPO is ₹10000/- to ₹140000. This means the minimum bid size should be ₹10000/- in which you will get a minimum of 769 shares if you consider ₹13 per share. The maximum share you can buy is 10,769 if you consider ₹13 per share.

In this article, I will discuss in detail about the ANYA IPO all details such as company overview, financial reports of Anya Polytech & Fertilizers, GMP premium, the purpose of IPO, valuation, and Industry & market trends.

Company Overview

Anya Polytech & Fertilizers is a manufacturer and trader of agricultural products such as fertilizers and manufacture of high-density polyethylene(HDPE) and bags which is known as polypropylene (PP) which is used in the packing of fertilizers, automotive parts, home/Industrial appliances, and PVC pipes. Anya also manufactures zinc sulfate.

The Anya Polytech & Fertilizers was founded in 2011, is based in New Delhi, and is ISO 9001:2015 certified. ISO 9001:2015 means the company is recognized (Globally) for its standard of quality management systems (QMS). Anya Ploytech is also focused on the quality management system (QMS) and diversifies its portfolio in several sectors of Agricultural products. Which enables them to attract more potential customer for their business. According to Screener, the current market capitalization of Anya Polytech is ₹168 crores (As of Dec 2024).

Objective Of ANYA IPO

Anya Polytech will utilize the issued funds for the following purposes:-

- The primary objective is to use funds for the working capital and capital expenditure.

- A chunk of the fund is used to fund a new project Yara Green Energy Private Limited, which is a subsidiary alongside its working capital needs.

- Also, the fund is used for the working capital and capital expenditure for Arawali Phosphate Limited, which is another subsidiary of Anya Polytech.

- The rest of the amount will be used for general corporate purposes.

Anya Polytech and Fertilizers IPO Details

| Stock Symbol | ANYA |

| Industry | Agricultural |

| Issue Size | ₹44 Cr |

| Lot Size | 10000 |

| Price Range | ₹13 – ₹14 |

| Bid Start Date | 26th Dec 2024 |

| Bid End Date | 30th Dec 2024 |

| Allotment Date | 31st Dec 2024 |

| Refund and Share Credit Date | 01st Jan 2025 |

| Listing Date | 02nd Jan 2025 |

| Mandate End Date | 14th Jan 2025 |

| Lock-in end Date | 31st Mar 2025 |

| Prospectus | Download |

ANYA GMP, Kostak Trends

GMP is a Grey market premium that is subject to trade at nonofficial exchanges.

| Date | GMP Price | Kostak | Subject to Sauda |

| 30- Dec 2024 (Closed) | ₹ 4 | – | 30400 |

| 29-Dec 2024 | ₹ 4 | – | 30400 |

| 28-Dec 2024 | ₹ 4 | – | 30400 |

| 27-Dec 2024 | ₹ 4 | – | 30400 |

| 26-Dec 2024 | ₹ 4 | – | 22800 |

Valuation of Anya Polytech & Fertilizers

All the valuations are in crores(Cr) INR. The source of the information is from Screener.

How to apply for ANYA IPO?

To apply any IPO one should have the Demat Account which is used for applying for IPO of any company. I will suggest you to open account in Zerodha which is the India’s best online discount broker. If you don’t have any Demat Account then click following link to open account in Zerodha.

- Login to Zerodh kite account.

- After login click on the Bids option in the top right header or click here.

- Find the symbol name ANYA (Remember to apply on or before 30th Dec 2024).

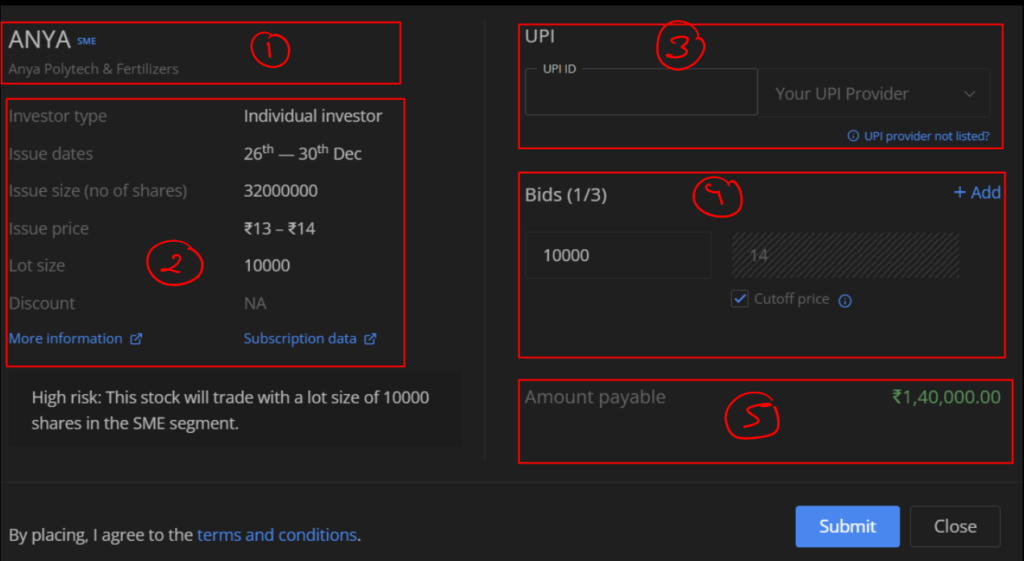

- Click Apply on the given name then a popup will open. I have explained each section in detail for the pop-up menu.

- Company Information (General details)

- General details of ANYA Infotech IPO.

- Here you have to fill in your UPI ID for the payment. The payment will be deducted immediately and if the share is allocated to you on allocation day then you will get the share credited to your account. If not then the refund will initiated in your bank account.

- This section is interesting. Here you have to give your bids. You can fill a maximum of 3 bids.

- To enter your custom price uncheck the cutoff price.

- The above segment will open to enter the price of your choice.

- The first input is lot size and the second input is for price.

- Based on your input in segment 4, the payable amount is calculated. For example, here the lot size is 10000 and the bid amount is ₹40, then the payable amount is 10,000 * ₹14 = ₹1,40,000/-

If you want to see more detail on the IPO then follow my blog here.

IPO is going to close on 30th Dec 2024 at 5 PM.